Liberty Mutual RightTrack is a reward program that rewards drivers who drive safely with insurance discounts for their automobiles. If an individual practices safe driving they are rewarded with a percentage discount on their insurance plan. However, what are the Liberty Mutual RightTrack Pros and Cons? Is it worth it?

The program tracks the drivers’ performance using a tracking device that collects their driving behaviors such as braking, speeds, and other driving data. The data is shared with the insurance company and then used to determine the discount earned.

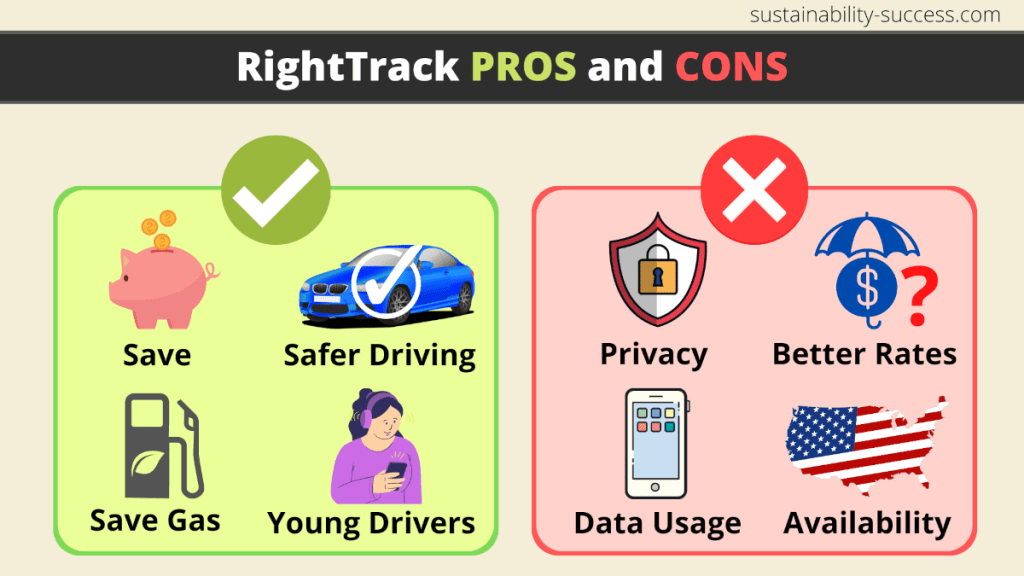

Here are the ✅ pros of RightTrack:

- Saves money on auto insurance

- Safer driving

- Save gas and be more eco friendly

- Easy and free to use

- Customized recommendations

- Does not increase premiums based on driving data

- Discount earned is for life

- Driving skill improvement

- Your data is NOT sold

- Excellent customer service

And here are the ❌ cons of RightTrack:

- Privacy concerns

- Not available in some states

- Some competitors may offer better rates

- Requires internet data access for the app to work

- The telematics devices may go faulty

- Could rate you even when not driving

- Plug-in devices not compatible with some vehicles

In this unbiased review, I will explain in more detail what “RightTrack” really entails, its pros, and its cons experienced by drivers. So if you wish to know if the insurance is worth investing in, I collected some unique insights for you. Now, let’s get into the Liberty Mutual RightTrack pros and cons. Keep reading!

PROS of RightTrack

Here are the main advantages of RightTrack by Liberty Mutual:

1. Saves money on auto insurance

Liberty Mutual RightTrack program allows every driver to reduce their auto insurance premium up to 30%. The better one drives, the lower they pay for insurance.

This is fair, especially to teen drivers, who are, in most cases, presumed to be poor drivers as they are new on the road. Those who drive safely get rewarded for their good road use.

Moreover, you will get a 10% discount straight away as soon as you join the RightTrack program, regardless of your driving skills. Not bad!

This is clearly the most significant advantage of Liberty Mutual RightTrack. By monitoring and analyzing driving behaviors, the program rewards safe and responsible drivers with lower insurance premiums.

Policyholders who exhibit cautious driving habits, such as maintaining lower speeds, smooth braking, and driving during less congested times, are more likely to qualify for substantial discounts. This provides an incentive for individuals to make conscious efforts to improve their driving habits and increase overall road safety.

However, it is worth noting that most users refer that the best they have ever received is 20% discount. Some even say that even with the best driving practices they never received anything above 15%. Some users argue that the system is somehow pegged at 15%. They argue that it could be either that the GPS module in the windshield device is faulty, or the program is engineered to reward that level of discount.

2. Safer driving

Liberty Mutual RightTrack offers policyholders the opportunity to gain insights into their driving habits. By using the RightTrack app, individuals receive real-time feedback on their driving behaviors, enabling them to become more aware of their actions on the road.

This feedback can empower drivers to make positive changes and develop safer driving habits, thereby reducing the chances of accidents or incidents. The program acts as a valuable tool for self-improvement, allowing policyholders to actively work towards becoming safer, more responsible drivers.

Drivers who use liberty mutual right track apps or the plug-in device tend to avoid hard breaks, accelerating fast, or driving past midnight. This contributes to good road discipline.

3. Save gas and be more eco friendly

As a car insurance program, RightTrack encourages people to drive more safely. Therefore, people will drive slowly and more carefully, which means less consumption of fuel.

Besides, careful use of vehicles helps to reduce the overall wear and tear of the tires and other components of the vehicle as well. This also means that in the long run, you will be saving money also on car maintenance!

Well-maintained cars that are driven more cautiously use little fuel and, as a consequence, have a less negative impact on the environment.

Therefore, you can contribute to improving environmental sustainability while actually saving money with insurance discounts and saving gas!

This, like using cruise control to save gas, is just a small example of how everybody can contribute to reducing waste and sustainable development.

4. Good for young drivers

RightTrack can be a good choice also for young drivers, in fact, even if you are under 25 you can get an instant 10% discount on your car insurance just because you joined the program.

Liberty Mutual can do this because the data shows that when drivers know that they are monitored, they immediately tend to drive more safely. In this way, the company can give you a discount on auto insurance right away just because you joined the program.

If you have a teenager in your family, then RightTrack can be an interesting option also for teenage drivers. This is not only because of the discounts but also because thanks to the tracking app, you will feel more secure in knowing that your loved one is driving safely.

5. Easy and free to use

Another advantage of Liberty Mutual RightTrack is its convenient and easy-to-use technology. The program provides policyholders with a small device or digital tag that seamlessly integrates with their vehicle.

The accompanying mobile app simplifies the tracking process, allowing users to monitor their driving habits effortlessly. The accessibility of this technology makes it convenient for individuals to participate in the program and potentially save money on their auto insurance premiums without any additional hassle.

RightTrack does not charge you anything for joining the program. All that a driver needs to do is download the app and sign up to start using the program.

However, you need to be a Liberty Mutual policyholder to be able to join the program. If you want to use the plug-in device, they ship it to you and give you a manual to help you plug it in easily.

6. Customized recommendations

The RightTrack program gives you access to your driving habits and enables you to check on yourself and know what to improve. The data collected is presented in report form for drivers to review and adjust their driving habits.

It takes 90 days to review. A driver gets enrolled to use the program after 90 days of review. This is quite some months, but it’s the shortest time compared to most insurances. During this period, drivers are analyzed; therefore, their driving habits determine the final score applied to your premium.

7. Does not increase premiums based on driving data

The data collected by the insurance company shows how good or bad of a driver one is. However, the company does not use this data to charge more premiums for poor drivers, the data is only used to calculate your discount. This looks pretty good indeed!

This discount-only program does not affect your premiums even when you drive poorly. However, if you would be deemed a risky driver, you may lose part of the discount you received when you joined the program.

8. Discount earned is for life

If a discount percentage is earned, it does not expire at any given moment. This will apply to your premiums if the policy is in place. Therefore you can use it anytime.

9. Your data is NOT sold

Liberty Mutual knows how to keep a juicy secret: your data! Yep, they’ve got your back when it comes to privacy. As stated in their T&C, you can rest easy knowing that Liberty Mutual doesn’t go around selling your precious information to the highest bidder.

However, they may use it to investigate claims (keep reading to discover how).

10. Excellent customer service

Liberty Mutual has earned a positive reputation for its customer service and claims handling. Many policyholders appreciate the company’s responsive customer service representatives and the timely processing of claims.

However, it’s important to note that negative reviews have been reported regarding difficulties in contacting claims adjusters and concerns about rate increases. Overall, Liberty Mutual strives to provide superior customer service and efficient claims handling, though individual experiences may vary.

CONS of RightTrack

There are also some important disadvantages of Liberty Mutual RightTrack that you should be aware of before signing up. Let’s have a look at the cons of this program.

1. Privacy concerns

When sharing driving data, the issue of privacy chips in. There is a worry about how the company uses and shares individual data collected through the program. This data includes the locations and car plate numbers. And you will have to keep the tracking app switched on everywhere you go.

This means that the insurance will know and record all of your movements. Moreover, the app will track also distracted driving, acceleration, braking, speed, mileage, and everything they need to evaluate your safe driving score.

This may be a concern for some people, while others may be ok with it. After all, it’s the 21st century and most of us are already tracked by other companies as well.

Finally, reading the RightTrack terms and conditions, as of today in 2023, I can read the following:

“We may use the data in connection with any insurance claim, including for purposes of reporting, investigating and adjusting such claim(s)”.

So, does RightTrack use the collected data to adjust claims? Yes, according to their T&C, they can. This means that they can use your data to investigate an eventual claim. For example, if the data show risky behavior during an accident, they may use it during the claim procedure.

2. Not available in some states

The program might not be available in some states. This means that some users cannot use it if they relocate to some states. his can be frustrating for individuals who live in areas where Liberty Mutual does not offer coverage. As reported on the Liberty Mutual website, here’s the list of states where RightTrack is available:

“RightTrack is available in these states: AL, AR, AZ, CO, CT, DE, FL, GA, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, NE, NH, NJ, NM, NV, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, VT, WI, WV, and Washington DC. New York customers can participate in the RightTrack Plug-in program.”

It should be taken into account that Liberty Mutual maintains a complaint rate concerning their automobile insurance that falls within the expected range reported to state regulators, considering the company’s scale. This indicates that although their coverage may be less widespread, the company consistently offers commendable service to their clientele.

3. Some competitors may offer better rates

When it comes to Liberty Mutual auto insurance, one potential downside is that the premiums can be higher compared to other providers. This means that some similar programs like Drive Safe and Save from other insurance companies may offer more competitive rates for your auto insurance.

While Liberty Mutual’s insurance costs are generally average in comparison to competitors, some drivers may find that their rates are higher than what they would pay with another company. This can be a disadvantage for individuals who are looking for the most affordable options.

However, it’s important to note that Liberty Mutual may still be one of the most affordable providers for younger drivers. The company offers a range of auto insurance discounts, which can help offset the higher premiums. These discounts can make Liberty Mutual a more cost-effective choice for younger drivers who are seeking insurance coverage.

4. Requires internet data access for the app to work

The app needs internet data to track the driver’s driving habits live. If the mobile data rates are expensive, then this means high cost for the driver as they try to keep their driving habits on track.

According to the company, the app uploads about 500-600KB of data per hour of driving, so if you have a plan with your mobile operator, this shouldn’t be a big issue.

5. The telematics devices may go faulty

The accuracy of the telematic devices is in question by some of the users. People with almost the same driving statistics could end up with different percentage discounts and most users may not understand why.

When capturing data with a phone, this could give inaccurate results especially where the internet is not stable and the system does not transmit accurate data.

According to some users’ experiences, they received multiple false accelerations and braking events throughout the Liberty Mutual RightTrack program. Despite claiming to be a cautious drivers, they were penalized for events that were inaccurately detected.

However, it is fair to say that the opinions of some users may be a bit biased, so it is up to you to decide how to interpret them.

6. Could rate you even when not driving

Some users raise the issue that they may be evaluated and analyzed even when they boarded someone else’s car without driving. This could happen if one does not confirm the trip or reject the trip. Therefore this could lead to inaccurate results.

7. Plug-in devices not compatible with some vehicles

Some states such as New York do not allow tracking via mobile phones, leaving drivers with only one option, to use the plug-in device. However, most cars made after 1996 are not compatible with the tracking device. This forces them to forgo the advantage.

What is Liberty Mutual RightTrack auto insurance?

The pioneering RightTrack initiative from Liberty Mutual is a groundbreaking program that empowers drivers to slash their auto insurance premiums. By harnessing the power of cutting-edge telematics technology, RightTrack meticulously assesses and dissects driving patterns to identify discounts that are tailor-made for each policyholder.

Its primary objective is to foster and incentivize the adoption of secure motoring practices, ultimately recognizing and rewarding conscientious drivers who consistently exhibit prudent conduct behind the wheel.

RightTrack is a user-friendly program that offers a straightforward process for policyholders. Once enrolled, policyholders may receive a small device that plugs into their car’s port under the steering wheel or a digital tag that can be attached to the windshield.

In conjunction with the device, policyholders can use the RightTrack app to track their driving habits and receive real-time feedback. The device or tag collects data on driving behaviors and sends it to Liberty Mutual for analysis.

What metrics does RightTrack monitor?

The program tracks the drivers’ performance using a tracking device that collects their driving behaviors such as braking, speeds, phone use while driving, and other driving data.

The data is shared with the insurance company and then used to determine the discount earned. This mode of operation makes Liberty Mutual odd from other classic insurance companies. However, one needs to examine if the whole thing is worth it before making their decisions.

The complete and updated list of all the tracked driver’s metrics is available on the Liberty Mutual website on this page.

Conclusion

If one needs to use the Liberty Mutual RightTrack device, it is easy to access. However, careful consideration helps you to make the right decision. So, is Liberty Mutual’s RightTrack program worth it? Well, it really depends on your individual preferences and driving habits. In fact, the Liberty Mutual RightTrack pros and cons may excite or put off some of you depending on your habits and expectations.

Here’s a quick summary of the pros and cons of RightTrack by Liberty Mutual:

| Pros | Cons |

|---|---|

| Saves money on auto insurance | Privacy concerns |

| Safer driving | Not available in some states |

| Save gas and be more eco friendly | Some competitors may offer better rates |

| Easy and free to use | Requires internet data access for the app to work |

| Customized recommendations | The telematics devices may go faulty |

| Does not increase premiums based on driving data | Could rate you even when not driving |

| Discount earned is for life | Plug-in devices not compatible with some vehicles |

| Driving skill improvement | |

| Your data is NOT sold | |

| Excellent customer service |

There are definitely some enticing pros to consider. Who doesn’t want the potential to save money on their auto insurance premiums? With usage-based tracking, good driving behavior can actually be rewarded with lower rates. Plus, the real-time feedback and insights provided by the program can help you become more conscious of your actions on the road. It’s like having your own personal driving coach!

However, there are a few potential cons to think about as well. The program does require the use of a mobile app or plug-in device, which might not be everyone’s cup of tea. Privacy concerns could also be raised by this requirement. Additionally, if you’re already a safe and conscientious driver, you might not benefit as much from the program.

Now that you know the advantages and disadvantages of RightTrack, you can make a more informed decision for your car insurance. Ultimately, it comes down to your own driving style and personal preferences. Take the time to evaluate whether Liberty Mutual’s RightTrack program aligns with your needs. Think about the pros and cons we’ve discussed here, and make an informed decision. After all, choosing the right insurance program should be as smooth and effortless as a leisurely drive on a sunny day!